pay utah property tax online

If you want to pay delinquent taxes you can only do so with a Cashiers Check or Money Order. Payments This section discusses information regarding paying your Utah income taxes.

Access Denied Industrial Condo Vineyard House Styles

Ad Check How to Qualify for the Child Tax Relief Program with Our Guide.

. Salt Lake County Treasurer. Please contact us at 801-297-2200 or taxmasterutahgov for more information. Pay For My Personal Property Taxes.

Filing Paying Detailed information about filing and paying your Utah income taxes. To pay Real Property Taxes. A processing fee will be charged for all online payments paid via debit or credit card of 25 of the transaction with a.

Online payments do not. See Property Records Tax Titles Owner Info More. This website is not available during scheduled system maintenance.

Salt Lake County personal property taxes must be paid on or before the deadline for timely payment shown on the tax notice or interest will begin to accrue. Your property serial number Look up Serial Number. Weber County property taxes must be brought in to our office by 5 pm.

Taxpayers paying online receive immediate confirmation of the payments made. Official site of the Property Tax Division of the Utah State Tax Commission with information about property taxes in Utah. You may also pay using ACH electronic.

Search Any Address 2. Ad Is Your Utah Dept of Revenue Bill Due Soon. Please note that for security reasons.

Youll need your 7-digit Account Number to make payment. On November 30 or 2. In TAP you can also file and pay taxes and manage your account including viewing correspondence we.

Click here to pay via eCheck. This web site allows you to pay your Utah County Personal Property Taxes online using credit cards debit cards or electronic checks. Review the Guidelines and Steps to Apply for the Child Tax Relief Program With Our Guide.

Property taxes can be paid online by credit card. Pay Your Bill Securely with doxo. Pay your taxes by phone.

You can pay online with an eCheck or credit card through Taxpayer Access Point TAP. Pay over the phone by calling 801-980-3620 Option 1 for real property. Find Your Account Number Here.

You may request a pay plan online at taputahgov by registering for a free account. To pay your taxes by phone dial 352 368-8200. Please contact us at 801-297-2200 or taxmasterutahgov for more information.

These are the payment deadlines. You may also pay with an electronic funds transfer by ACH credit. They conduct audits of personal.

Pay Property Tax Taxes are Due November 30 2021. What you need to pay online. Search Valuable Data On Properties Such As Liens Taxes Comps Foreclosures More.

Be Postmarked on or before November 30 2022 by the United. The Personal Property Team within the Property Tax Division develops depreciation schedules used by assessors in the valuation of personal property. Click the link above to be directed to TAP Utahs Taxpayer Access Point DO NOT LOGIN OR CREATE A LOGIN Go to Payments and select either Make e-Check Payment or.

A processing fee will be charged for all online payments paid via debit or credit card of 25 of the transaction with a minimum charge of 250. Online PERSONAL Property Tax Payment System.

Use Smartasset S Utah Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Retirement Calculator Property Tax Financial

Utah Tax Break Program Could Be A Lifeline For Seniors

Utah Property Taxes Utah State Tax Commission

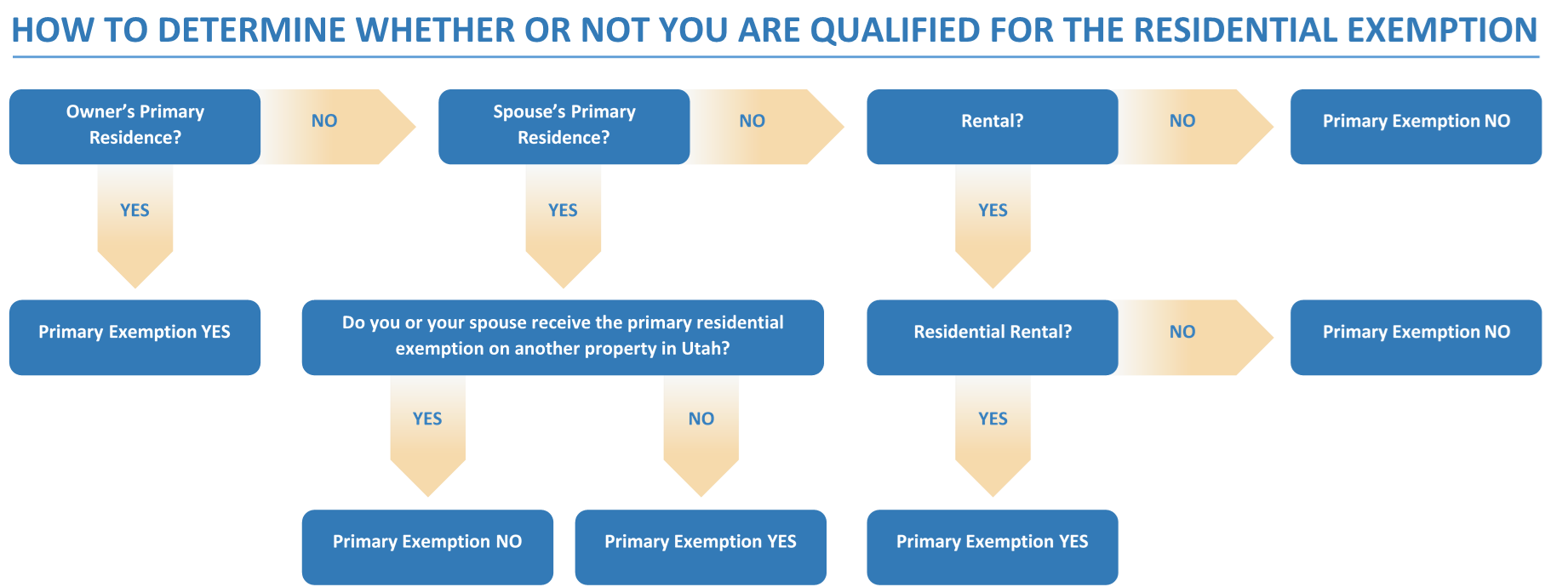

Residential Property Declaration

137 E Twin Hollow Dr Mapleton Ut 84664 Mls 1820733 Zillow In 2022 Backyard Covered Patios House System House Styles

Utah Property Tax Calculator Smartasset

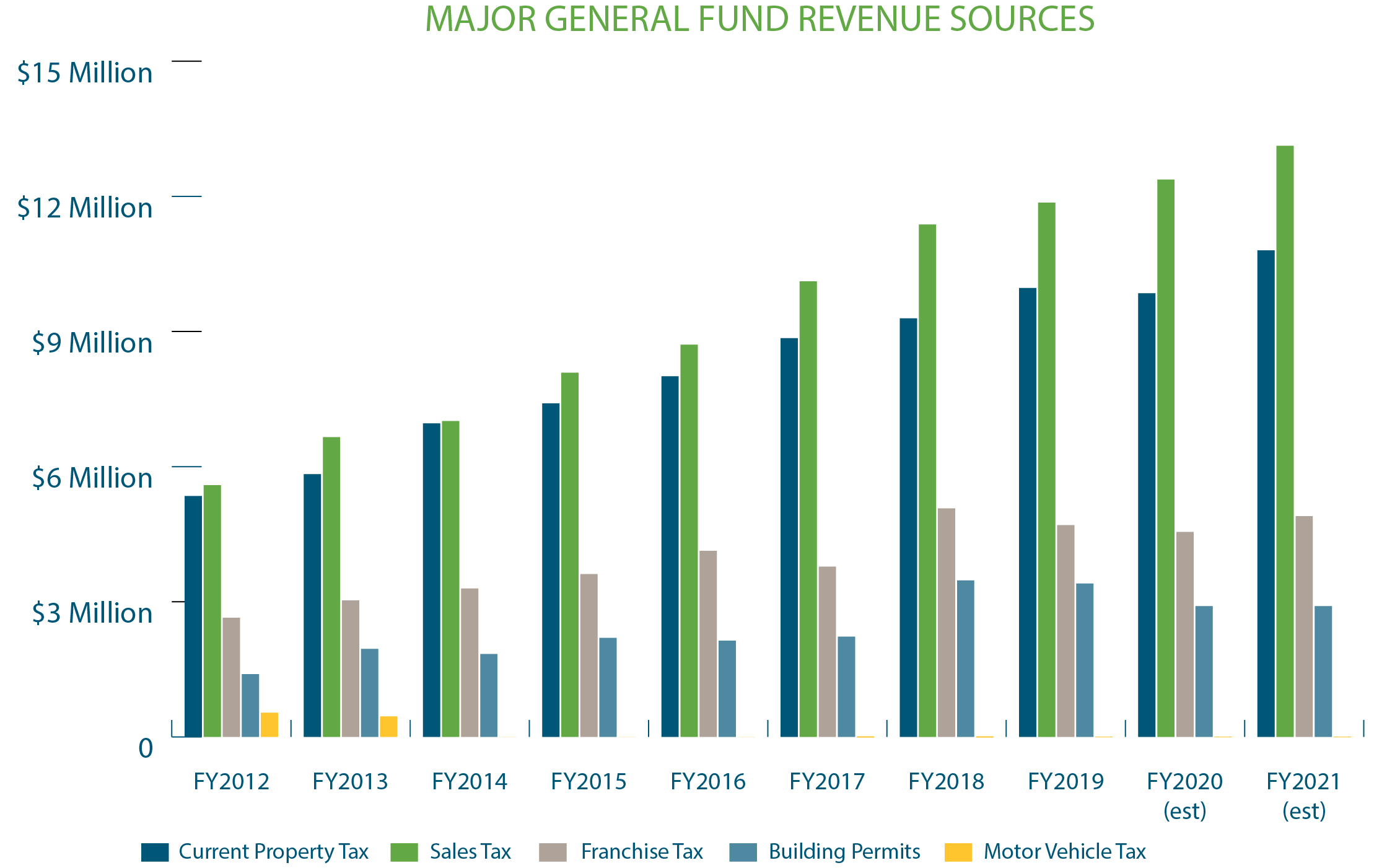

Utah County Raises Property Taxes 67 Ke Andrews

Midwestern Fabricators At 1235 South Pioneer Road 2700 West Salt Lake City Ut 84104 For Sale 2 400 000 Desc Acre Commercial Real Estate Salt Lake City

3 Money Saving Tax Tips For Homeowners Utah Listing Pro Save Money Tax Tips Homeowner Tips Tax Season Real Estate Ta Tax Money Tax Season Saving Money

Printable Sample Free Rental Application Form Form Rental Application Real Estate Forms Application Form

Utah Eviction Law Lease Termination Being A Landlord Lease Eviction Notice

How Long Does A Home Inspection Take Gary Buys Houses Home Inspection Selling Strategies Home Buying

Utah State Tax Commission Notice Of Change Sample 1